Retirement plans as a recruiting tool are a proven strategy to attract potential employees that wouldn’t consider working with you otherwise.

GroupRetirement

Retirement plans as a retention tool are a great perk for current valued employees, helping ensure they don’t move to another employer just to get a pension.

Doing the right thing by providing retirement benefits to your employees it can make the difference between them being set for retirement or having to work past their planned retirement age.

Retirement plans create happy employees which improves productivity, means less absenteeism and contributes to higher morale. Healthy and financially secure employees are generally more positive about their place of work and more loyal to their employers.

The number of employees you have

If the plan is voluntary or mandatory for employees to enroll

The number of employees who sign up for the plan if enrolment is voluntary

The income level of employees

If the plan has an annual cap on the company contribution to an employee’s account

How long employees must work for the Company before they can join the plan

Take advantage of employee benefit opportunities

Hello,

Your questions are important to us at BF Partners. Thank you for your inquiry. One of our Senior Associates will follow up with you by phone and email within the next business day. Please call 1-866-442-2587 if you have any immediate questions.

Best regards,

Paul Bajus

Director Group Retirement

Oops, there was an error sending your message.

Please try again later or call us at 1-866-442-2587. Our apologies for any inconvenience.

Hello,

Your questions are important to us at BF Partners. Thank you for your inquiry. One of our Senior Associates will follow up with you by phone and email within the next business day. Please call 1-866-442-2587 if you have any immediate questions.

Best regards,

Paul Bajus

Director Group Retirement

Oops, there was an error sending your message.

Please try again later or call us at 1-866-442-2587. Our apologies for any inconvenience.

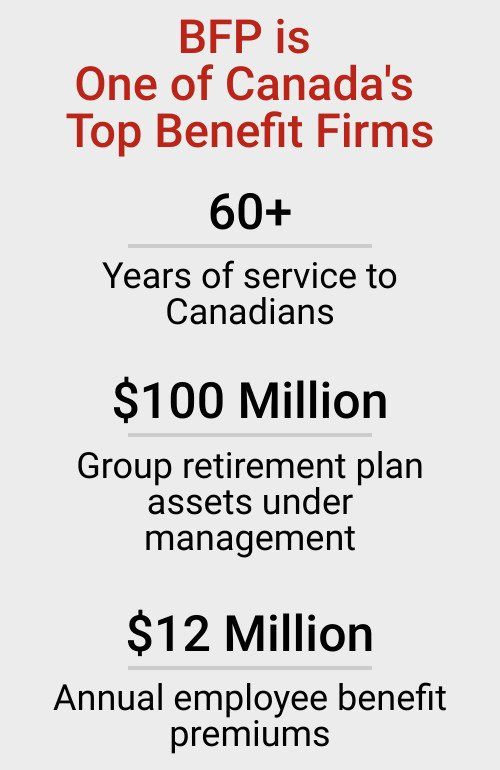

Group Retirement

Retirement plans as a recruiting tool are a proven strategy to attract potential employees that wouldn’t consider working with you otherwise.

Retirement plans as a retention tool are a great perk for current valued employees, helping ensure they don’t move to another employer just to get a pension.

Doing the right thing by providing retirement benefits to your employees can make the difference between them being set for retirement or having to work past their planned retirement age.

Retirement plans create happy employees which improves productivity, means less absenteeism and contributes to higher morale. Healthy and financially secure employees are generally more positive about their place of work and more loyal to their employers.

The number of employees you have

If the plan is voluntary or mandatory for employees to enroll

The number of employees who sign up for the plan if enrolment is voluntary

The income level of the employees

If the plan has an annual cap on the compnay contribution to an employee's account

How long employees must work for the Company before they can join the plan

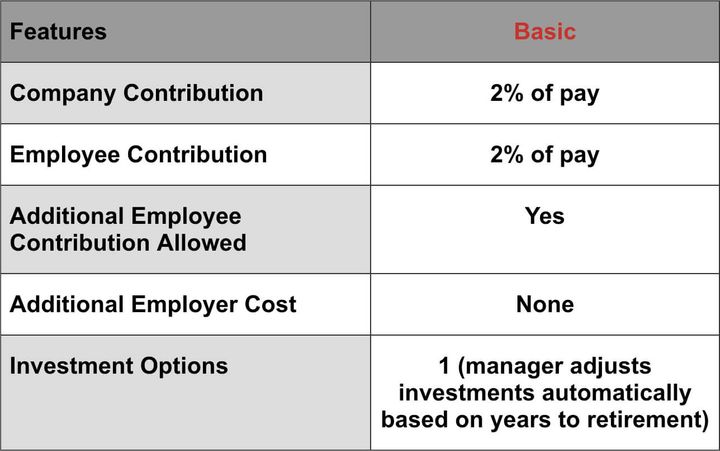

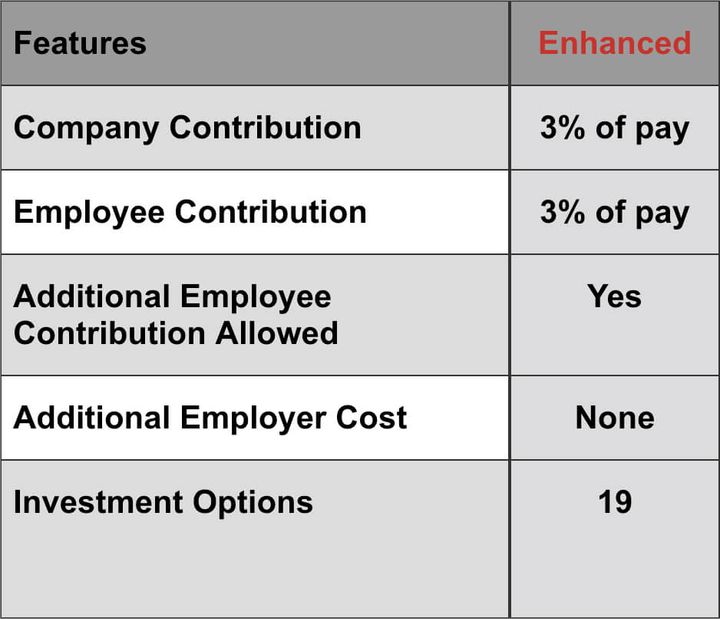

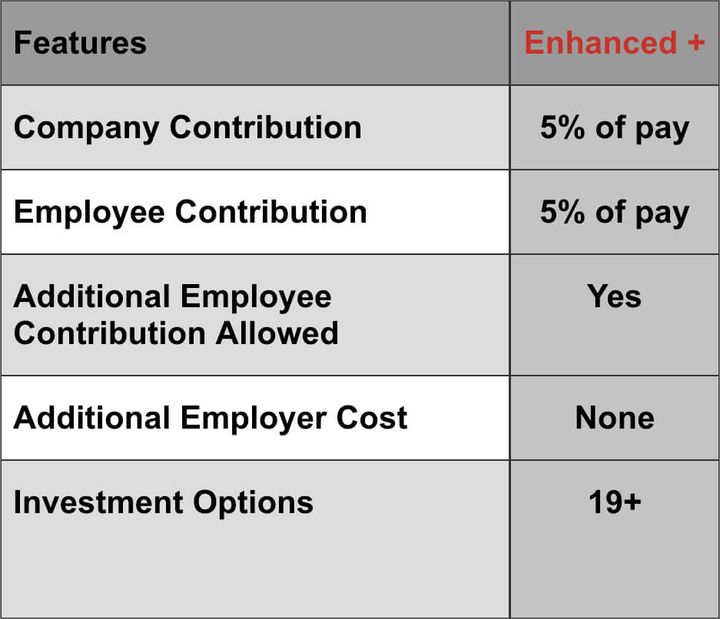

| Features | Basic | Enhanced | Enhanced + |

|---|---|---|---|

| Company Contribution | 2% of pay | 3% of pay | 5% of pay |

| Employee Contribution | 2% of pay | 3% of pay | 5% of pay |

| Additional Employee Contribution Allowed |

Yes | Yes | Yes |

| Additional Employer Cost | None | None | None |

| Investment Options | 1 (manager adjusts investments automatically based on years to retirement) |

19 | 19+ |

| Features | Basic | Enhanced | Enhanced + |

|---|---|---|---|

| Company Contribution | 2% of pay | 3% of pay | 5% of pay |

| Employee Contribution | 2% of pay | 3% of pay | 5% of pay |

| Additional Employee Contribution Allowed |

Yes | Yes | Yes |

| Additional Employer Cost | None | None | None |

| Investment Options | 1 (manager adjusts investments automatically based on years to retirement) |

19 | 19+ |

Take advantage of employee benefit opportunities

Hello,

Your questions are important to us at BF Partners. Thank you for your inquiry. One of our Senior Associates will follow up with you by phone and email within the next business day. Please call 1-866-442-2587 if you have any immediate questions.

Best regards,

Paul Bajus

Director Group Retirement

Oops, there was an error sending your message.

Please try again later or call us at 1-866-442-2587. Our apologies for any inconvenience.

Hello,

Your questions are important to us at BF Partners. Thank you for your inquiry. One of our Senior Associates will follow up with you by phone and email within the next business day. Please call 1-866-442-2587 if you have any immediate questions.

Best regards,

Paul Bajus

Director Group Retirement

Oops, there was an error sending your message.

Please try again later or call us at 1-866-442-2587. Our apologies for any inconvenience.