Blog Post

Group Retirement Evolution

- By Paul Bajus

- •

- 19 Mar, 2018

- •

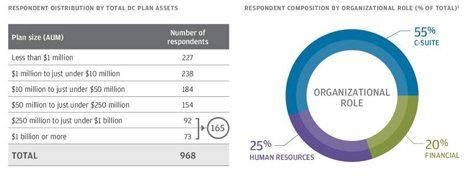

J.P. Morgan in the U.S. recently published their 2017 Defined Contribution Pension Plan Sponsor Survey Findings, and it was interesting because the U.S. tends to be ahead of where we are in a lot of areas, pensions being one of them. This is the group they surveyed:

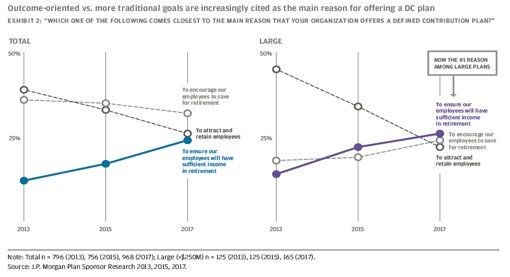

Yes, there are some massive plans included with appropriately massive resources to put towards employee wellness and “financial wellness” in particular, but there is also a good cross section of plans of all sizes. The biggest takeaway that I got from the study is that there is a big increase in the number of organizations that are taking an active role in trying to make sure their employees will have sufficient income in retirement. That is a big progression from just “offering a plan”. In my mind there are kind of 3 steps, 1) Offering a plan. Just having it on the shelf as part of the employee’s benefits. 2) Having an Optimal Plan. Having a plan that you are continuously trying to improve on and communicate with the employees about. 3) Helping employees reach their retirement income goals. Here you have taken things one step further and are focused on the outcome of the plan instead of just the plan itself.

What can plan sponsors do to help their employees reach their retirement income goals?

- Realize that they have a fiduciary duty to plan members regardless of their involvement.

- Do your due diligence by meeting with your plan advisor regularly.

- Consider doing a re-enrolment. A plan re-enrolment is when the members are notified that their assets and future contributions will be invested in the target date fund closest to their 65th birthday unless they specify a new investment direction by a certain time period. This is pretty radical and wouldn’t be a good thing for all plans, but certainly some of the ones with the greatest amount of member apathy it’s worth considering.

- Allow meetings with plan advisors during company time.

- Communicate with plan members regularly to keep them engaged with the plan.

What can plan advisors do to help plan members reach their retirement income goals?

- Make sure target date funds are offered and most times used as the default.

- Work with the plan sponsor to find ways to communicate with their members in a way that works for them. That can include articles on the company intranet, group meetings for all members, group meetings for targeted groups of members – ie those within 10 years of retirement, and individual meetings.

- Show members how to do an illustration of what their income might look like at retirement, or offer to do that for them.

Paul Bajus - CLU, CFP, CHS - is the Director of Director, Pensions and Corporate Wealth Management for BF Partners. Learn more about Paul.

Share

Tweet

Share

Mail

© 2024 BFPartners.

© 2024 BFPartners. All Rights Reserved.

© 2024 BFPartners. All Rights Reserved.