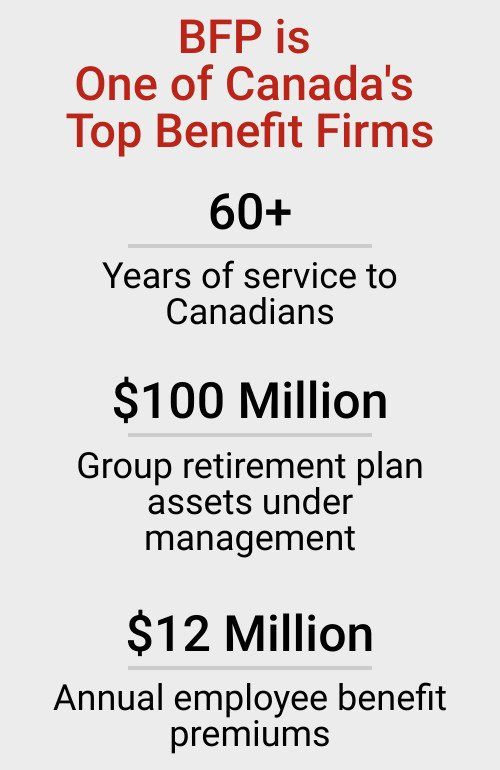

Affordable Group RRSPs for Your Business

Employer Health Tax (EHT): A Huge Company Payroll Tax Expense, Why Increase It If You Don’t Have To?

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their staff. Payroll taxes generally fall into two categories: deductions from an employee's wages, and taxes paid by the employer based on the employee's wages.

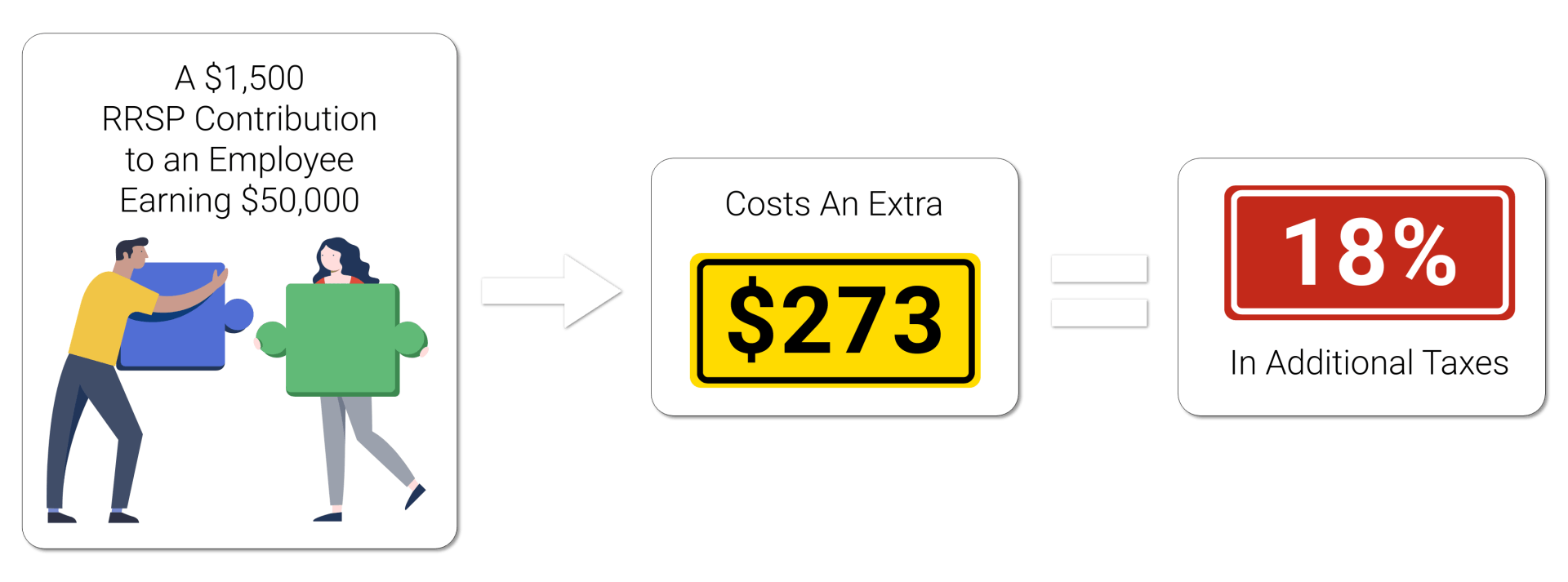

The new 1.95% Employer Health Tax is a Payroll tax that can create a huge company expense, quickly - since its calculated on both the salaries and Group RRSP Plans you provide to employees.

At BFP we can help you restructure your Group RRSP to avoid these taxes!

Why Does A Group RRSP Create Additional Payroll Taxes?

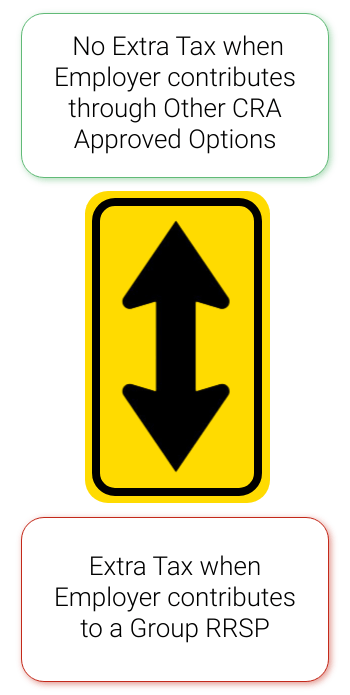

Most Group RRSP's are set up so employees make a contribution to their Group RRSP account and the employer matches that contribution. The employer matching contribution to the employee's Group RRSP account must be added to that employee's T4 taxable income, according to Canada Revenue Agency (CRA) rules.

This means that employer's Group RRSP contributions to an employee's RRSP are now subject to 1.95% of Additional Health Taxes because it is T4 income! This also attracts other payroll taxes such as CPP, EI and WCB.

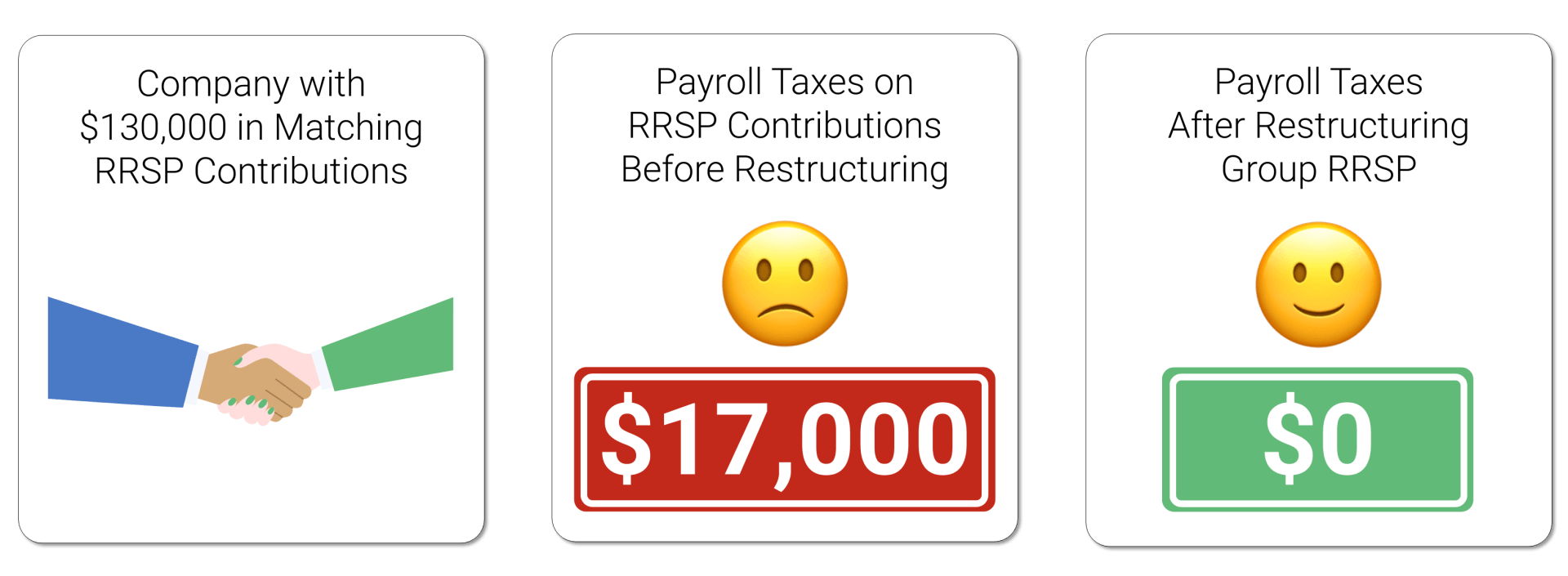

Consider the Following Example

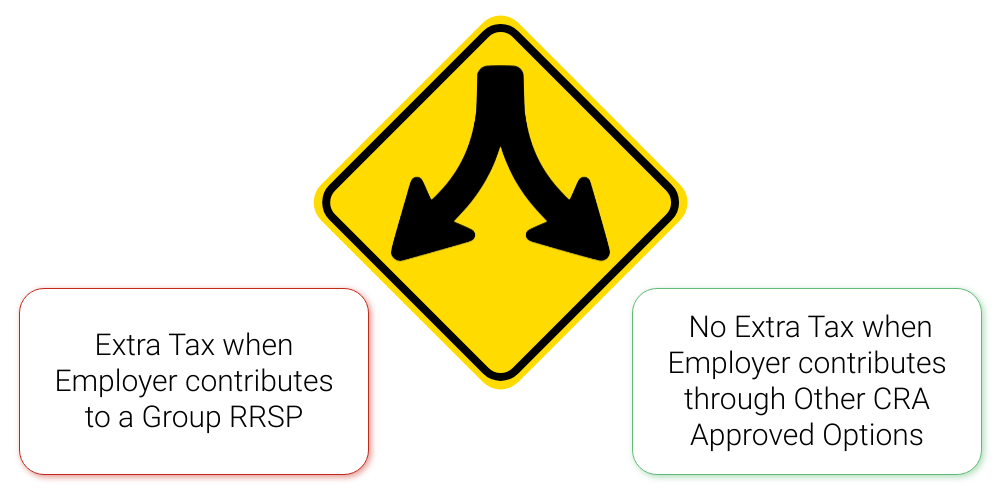

What Are Your Options to Minimize Group RRSP Payroll Taxes?

Changing the type of matching contribution made to a Group RRSPs can minimize extra payroll taxes from matching Employer RRSP contributions and work within CRA rules. Options include: a Structured RRSP, a DPSP (deferred profit sharing plan) or a Money Purchase Pension Plan (MPP).

Each of these alternates has different features and rules that allow Employers to keep the plan Simple for employees, Simple for the company, and, most importantly, eliminate payroll taxes! In all cases employee RRSP contributions do not have to change.

How much could my Company save by using BFP to restructure my Group RRSP and avoid payroll taxes?

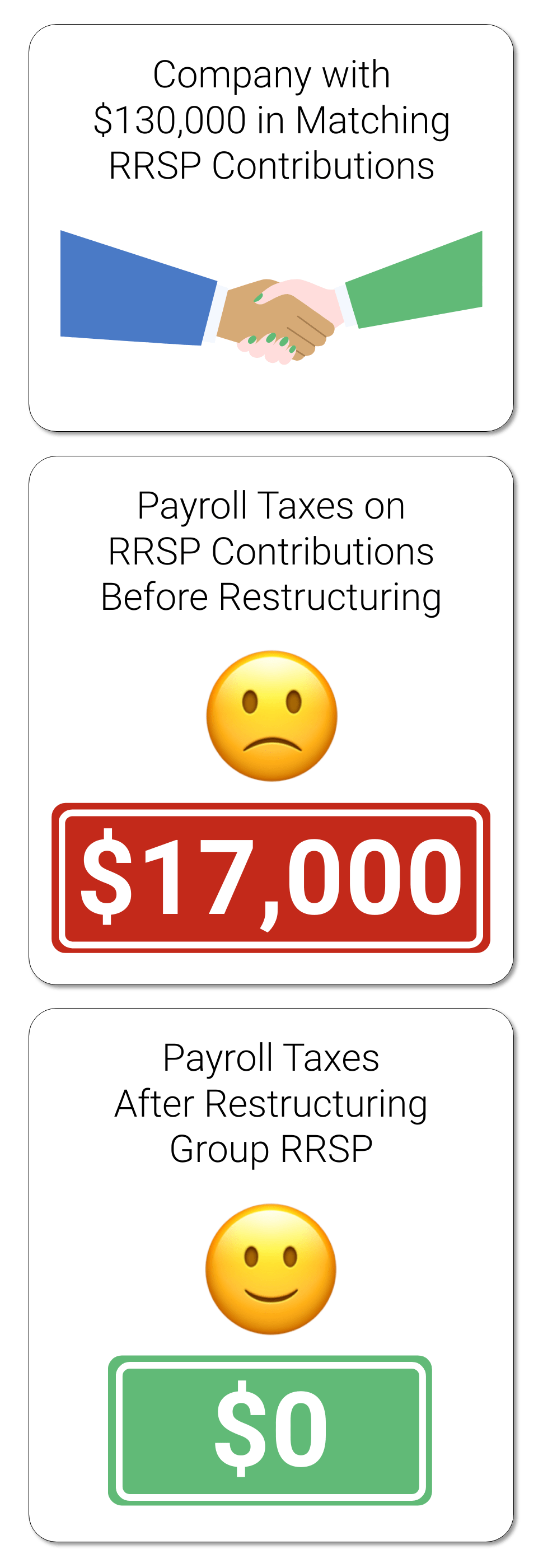

A Case Study On Savings From BFP Restructuring A Group RRSP

BFP was contacted by a manufacturing company with about 100 employees to audit their plan and see what payroll tax savings could be achieved by restructuring their Group RRSP. Their WCB rate was 4.89% of payroll. Total company payroll was 6 million. 75% of employees were enrolled in the Group RRSP account. The total company match contribution was $130,000 annual, based on a 3% matching formula.

By switching the Company match contributions into one of the three other options allowed by CRA, the Company saved nearly $13k a year in payroll taxes and also reduced payroll taxes paid by employees by almost $4000. The employees still get one statement, still have all investment options available to them, and still have the same options to choose from at retirement or termination from the company.

Group RRSP Frequently Asked Questions

General Group RRSP Questions

"Non" specialists, may not fully understand all your options. Our senior advisors at BFP are well versed in Corporate Finance and Planning to understand the impacts of company finances that setting up a group RRSP creates. We keep up to date on all the latest regulations and changes to ensure our clients Retirement Plan minimize taxes with their business structures, maximize returns and are adjusted as tax and CRA rules change.!

There are little to zero downsides, and possibly some upsides. An audit report from BFP will review your options and how these options compare to your current Group RRSP plan.

Some differences could be as follows: a) Home Buyers Plan no longer available for the Company Match account (still OK for employee account). b) the company can put in a vesting schedule if they wish, that will not allow employees to take the company money with them if they leave before they have worked for a pre-set period of time, for example one year.

Complete the form below or call us at 1-866-442-2587 for a free consultation, or email us at

[email protected]. We can confidently discuss your current Group RRSP plan and determine if we move forward together with an audit analysis.

Start Your Free Quote Today

Take advantage of Group Retirement planning and Payroll Tax Savings

Or call 1-866-442-2587 Monday - Friday 9am to 6pm

Filling out this form will give you a good start on learning the best rates and plans available

Filling out this form will give you a good start on learning the best options to save on taxes applicable to matching Group RRSP contributions.

Desirable for All Businesses

It pays for Business to take advantage of minimizing payroll taxes for Group RRSP contributions.

Efficient

– Maintain your current Employer RRSP Contributions without paying additional taxes or incurring restructuring expenses.

Manageable

– A group retirement plan is very easy to manage; monthly contributions to the plan are made by a designated administrator at your company in a single lump sum to the plan provider. The plan provider and BFPartners handle all other financial matters.

Consistent– Your cost sharing arrangement with employees does not have to change. Employees continue to contribute in the same manner as they do now.

Tax Benefits

– Group Retirement plan options are all within Canada Revenue Agency guidelines and regulations. Creates a tax deduction for both the company and the employee. Compared to a wage increase, Group Retirement plan adjusts for RRSP contributions will not increase payroll taxes such as EI, CPP and WCB.

Benefits and Pensions Blogs

“Bajus Financial provides Haney Builders Supplies with a group benefit plan with our best interests in mind. Mark Bajus and his team tailored our plan focusing on our budget with low cost options while ensuring we take advantage of new plan options that would provide additional peace of mind to our employees. Our group benefits plan has attracted and retained valuable employees to aid in the success of our business. This approach to service is why I highly recommend the Bajus Financial team for your benefits plan.”

Karl Peters

Controller, Haney Builders Supplies

“Mark spent a great deal of time working out a custom benefit plan solution for us, and it has worked out great. Staff really appreciate that as a small business, we have committed to them with a great benefit plan that’s highly affordable."

Louis Ramos

President, Ramos Holdings Ltd